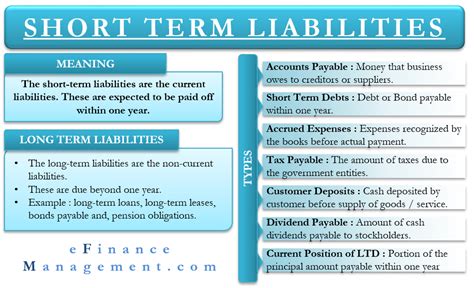

short-term debt & capital lease obligations hermes | current short term liabilities include short-term debt & capital lease obligations hermes Learn what short/current long-term debt is and how it's reported on a company's balance sheet. Find out the difference between short- and long-term debt, and see an example of how to. Dr Korlipara is a Consultant Neurologist in the Queen Square Movement Disorders group based at the National Hospital for Neurology and Neurosurgery, Queen Square, London. After graduation he trained in general medicine in the Hammersmith Hospitals NHS Trust and Royal Free Hampstead NHS Trust.

0 · short term liabilities vs long

1 · short term liabilities examples

2 · short term debts examples

3 · short term debt vs long

4 · short term borrowings current liabilities

5 · short term assets and liabilities

6 · examples of short term loans

7 · current short term liabilities include

Per eBay guidelines, the most significant flaw will anchor the condition of the card. Buy It Now Pokémon TCG Drapion LV.X Platinum 123/127 Holo Rare Holo LV.X. 2009

Short-term debt is any debt obligations that a company needs to pay back within the next 12 months or within the current fiscal year. It includes accounts payable, lease . Short-term debt, also called current liabilities, is a firm's financial obligations that are expected to be paid off within a year. Learn about the types, measures, and implications of. Short-term debt is any debt obligations that a company needs to pay back within the next 12 months or within the current fiscal year. It includes accounts payable, lease payments, wages, income taxes payable, and short-term bank loans.Learn what short-term debt is, how it differs from long-term debt, and what types of debt are included in it. Find out how to assess a company's debt using financial ratios and metrics.

Learn what short/current long-term debt is and how it's reported on a company's balance sheet. Find out the difference between short- and long-term debt, and see an example of how to.

Short-term debt is a financial obligation that must be repaid within a year. Learn about the types of short-term debt, such as short-term loans, commercial paper, and accounts payable, and the advantages and disadvantages of using them.Short-term debt is typically used to finance a company's day-to-day operations, such as purchasing inventory, meeting payroll, and covering other immediate expenses. The use of short-term debt allows companies to maintain flexibility and . Current liabilities are short-term financial obligations that are due within one year or within a normal operating cycle. Learn how to calculate and interpret the current ratio and the quick.

Short-term debt is the amount of a loan that is payable to the lender within one year. Other types of short-term debt include accounts payable, commercial paper , lines of credit , and lease obligations.

Learn the difference between long-term and short-term debt, and how they are recorded on a company's balance sheet. See common examples of each type of debt, such as bonds, notes payable,. Learn what short-term debt is and how it affects a company's financial health and cash flow. Find out the common types of short-term debt, such as bank loans, trade credit, commercial paper, and accounts payable. Short-term debt, also called current liabilities, is a firm's financial obligations that are expected to be paid off within a year. Learn about the types, measures, and implications of. Short-term debt is any debt obligations that a company needs to pay back within the next 12 months or within the current fiscal year. It includes accounts payable, lease payments, wages, income taxes payable, and short-term bank loans.

Learn what short-term debt is, how it differs from long-term debt, and what types of debt are included in it. Find out how to assess a company's debt using financial ratios and metrics. Learn what short/current long-term debt is and how it's reported on a company's balance sheet. Find out the difference between short- and long-term debt, and see an example of how to.Short-term debt is a financial obligation that must be repaid within a year. Learn about the types of short-term debt, such as short-term loans, commercial paper, and accounts payable, and the advantages and disadvantages of using them.Short-term debt is typically used to finance a company's day-to-day operations, such as purchasing inventory, meeting payroll, and covering other immediate expenses. The use of short-term debt allows companies to maintain flexibility and .

Current liabilities are short-term financial obligations that are due within one year or within a normal operating cycle. Learn how to calculate and interpret the current ratio and the quick.

short term liabilities vs long

short term liabilities examples

Short-term debt is the amount of a loan that is payable to the lender within one year. Other types of short-term debt include accounts payable, commercial paper , lines of credit , and lease obligations.

Learn the difference between long-term and short-term debt, and how they are recorded on a company's balance sheet. See common examples of each type of debt, such as bonds, notes payable,.

short term debts examples

short term debt vs long

L V Prasad Eye Institute, Kode Venkatadri Chowdary Campus, Vijayawada Contact at: 0866 - 6712020, 0866 - 6712009. . Dr Subhadra Jalali participated in educational sessions held at Jammu. 03rd April 2024; LVPEI and AIOS team up for 2nd Incubator Start-up Challenge. 01st April 2024;

short-term debt & capital lease obligations hermes|current short term liabilities include